Industry Affairs Update

Access Industry News from Around the World

The IDA Industry Affairs Update includes an overview of the construction economy and related trends as well as news alerts about legislative and regulatory activity that impact the door industry.

The IDA Industry Affairs Update includes an overview of the construction economy and related trends as well as news alerts about legislative and regulatory activity that impact the door industry.

Industry Affairs News Archives

IDA hosted a webinar to update our members on the Florida Home Hardening Sales Tax Exemption for impact-resistant garage doors that went into effect on July 1, and the My Safe Florida grant program. The sales tax exemption exempts Florida homeowners from sales tax on impact-resistant doors, windows, and garage doors anywhere in the state from July 1, 2022 through June 30, 2024. Visit this webpage to learn more about the sales tax exemption. The IDA webinar was recorded and is available here.

The grant program is still under development and IDA will monitor that program and share additional information when it becomes available. See this webpage for more information.

The State of Florida issued a Tax Information Publication (TIP) to help dealers understand the program; you can view the document here. This publication includes the following:

A temporary sales tax exemption period on impact-resistant doors, impact-resistant garage doors, and impact-resistant windows begins July 1, 2022, and ends June 30, 2024. During this sales tax exemption period, tax is not due on the retail sales of impact-resistant doors, impact-resistant garage doors, and impact-resistant windows for commercial or noncommercial use. “Impact-resistant doors,” “impact-resistant garage doors” and “impact-resistant windows” refer to doors, garage doors or windows that are labeled as impact-resistant or have an impact-resistant rating.

References: Section 52, Chapter 2022-97, Laws of Florida; Emergency Rule 12AER22-7, Florida Administrative Code

The TIP also advises dealers on how to comply with the sales tax exemption:

Florida dealers should report the sales of impact-resistant doors, impact-resistant garage doors, and impact-resistant windows sold during the sales tax exemption period as exempt sales on their sales tax

returns.

Note that Florida TIP excerpt above includes commercial and non-commercial uses for the sales tax exemption. While the terms do not specifically call out the Florida Product Approval system, IDA recommends that dealers select products that meet the impact resistance provisions in the Florida Product Approval system, and include the manufacturer’s FL# from the Florida product approval database. If your company does not hold a valid Annual Resale Certificate from the State of Florida, you should consult your tax preparer or legal counsel to determine how to participate in the sales tax exemption program.

IDA has been working to help door dealers take advantage of Florida’s efforts to improve the building stock to better resist damage from tropical storm and hurricane events. If you have any questions on these programs, or on IDA’s advocacy efforts, reach out to us at info@doors.org.

IDA Industry Affairs Report March 2022

The First Quarter of 2022 is in the Books. The Results for Residential Construction? Mixed.

New Residential Housing Starts and Building Permits

The single-family housing market showed signs of softening at the end of the first quarter; permits and starts declined due in part to increased mortgage rates and the continued supply chain issues that cause delays and cost increases.

Overall housing starts increased 0.3% to a seasonally adjusted annual rate of 1.79 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau; that increase was fueled by a strong multi-family market.

“Higher mortgage interest rates and rising construction costs are pricing buyers out of the market, and these higher costs are particularly hurting entry-level and first-time buyers,” said Jerry Konter, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from Savannah, Ga. “Policymakers must address building supply chain disruptions to help builders bring down construction costs and increase production to meet market demand.”

“The shift in affordability can be seen in the March data with strength for multifamily construction and some weakness for single-family permits,” said NAHB Chief Economist Robert Dietz. “Our builder surveys show that confidence levels in the single-family market have declined for four straight months as affordability conditions continue to worsen, and this is a sign that single-family production will face challenges moving forward.”

Building permits increased overall by 0.4% to a 1.87 million-unit annualized rate in March. Single-family permits decreased 4.8% to a 1.15 million-unit rate; while multifamily permits increased 10.0% to an annualized 726,000 pace.

Single-family permits issued but not yet started are at 149,000 units and are up 14.6% year-over-year. Higher construction costs and material delays continue to slow previously permitted projects; creating a lag in starts but signaling strong backlog.

For more info visit:

https://www.nahb.org/news-and-economics/press-releases/2022/04/single-family-permits-decline-in-march-as-affordability-woes-continue

Building Material Costs

The prices of goods used in residential construction rose 1.4% in March, following an increase of 2.2% in February and 4.1% in January according to the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics. This has resulted in an 8% increase in building materials prices since the start of the year. Building material costs have increased 20.4% year over year and are up 33% since the first quarter of 2020 and the start of the pandemic.

Fore more information visit:

https://www.nahb.org/blog/2022/04/building-materials-prices-start-2022-with-8-percent-increase

Existing Homes Sales

The results for existing home sales are mixed; sales fell for the second straight month in March to a seasonally adjusted annual rate of 5.77 million, down 2.7% from February month and 4.5% from a year ago. This slower demand resulted in an increase in the inventory of unsold existing homes as it increased to 950,000; that level would support two months of the current sales pace. Prices continued to increase as the median existing-home sales price rose to $375,300, up by 15% from 2021.

From the National Association of Realtors:

WASHINGTON (April 20, 2022) – Existing-home sales decreased in March, marking two consecutive months of declines, according to the National Association of Realtors®. Month-over-month, sales in March waned in three of the four major U.S. regions while holding steady in the West. Sales were down across each region year-over-year.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dipped 2.7% from February to a seasonally adjusted annual rate of 5.77 million in March. Year-over-year, sales fell 4.5% (6.04 million in March 2021).

“The housing market is starting to feel the impact of sharply rising mortgage rates and higher inflation taking a hit on purchasing power,” said Lawrence Yun, NAR’s chief economist. “Still, homes are selling rapidly, and home price gains remain in the double-digits.”

With mortgage rates expected to rise further, Yun predicts transactions to contract by 10% this year, for home prices to readjust, and for gains to grow around 5%.

Total housing inventory at the end of March totaled 950,000 units, up 11.8% from February and down 9.5% from one year ago (1.05 million). Unsold inventory sits at a 2.0-month supply at the present sales pace, up from 1.7 months in February and down from 2.1 months in March 2021.

The median existing-home price for all housing types in March was $375,300, up 15.0% from March 2021 ($326,300), as prices rose in each region. This marks 121 consecutive months of year-over-year increases, the longest-running streak on record.

“Home prices have consistently moved upward as supply remains tight,” Yun said. “However, sellers should not expect the easy-profit gains and should look for multiple offers to fade as demand continues to subside.”

Properties typically remained on the market for 17 days in March, down from 18 days in February and 18 days in March 2021. Eighty-seven percent of homes sold in March 2022 were on the market for less than a month.

First-time buyers were responsible for 30% of sales in March, up from 29% in February and down from 32% in March 2021. NAR’s 2021 Profile of Home Buyers and Sellers – released in late 20214 – reported that the annual share of first-time buyers was 34%.

“It appears first-time homebuyers are still looking to lock in at current mortgage rates before they inevitably increase,” Yun said.

Individual investors or second-home buyers, who make up many cash sales, purchased 18% of homes in March, down from 19% in February but up from 15% in March 2021. All-cash sales accounted for 28% of transactions in March, up from both the 25% recorded in February and from 23% in March 2021.

“With rising mortgage rates, cash sales made up a larger fraction of transactions, climbing to the highest share since 2014,” Yun said.

Distressed sales – foreclosures and short sales – represented less than 1% of sales in March, equal to the percentage seen in both February 2022 and March 2021.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 4.17% in March, up from 3.76% in February. The average commitment rate across all of 2021 was 2.96%.

Source:

https://www.nar.realtor/newsroom/existing-home-sales-slip-2-7-in-march#:~:text=Eighty%2Dseven%20percent%20of%20homes,from%2032%25%20in%20March%202021.

IDA Industry Affairs Report February 2022

US-Japan Tariff Deal

On February 7, 2022, United States Trade Representative Katherine C. Tai and United States Secretary of Commerce Gina M. Raimondo announced rollbacks of Trump-era tariffs impacting steel and aluminum imports with a new agreement with Japan to allow Japanese steel products to enter the U.S. market without the application of Section 232 tariffs.

While the impact to the supply of raw materials into the US manufacturing base will evolve over the coming months and beyond, it is expected to ease supply chain constraints. How and when it will impact the door industry remains to be seen.

As implemented during the Trump administration’s efforts to boost US steel production, the tariffs tightened demand and impacted the supply chain. Balancing the calls from domestic steel producers- and their union interests- with capacity constraints that fueled higher steel pricing and impacted US manufacturing during the pandemic has been difficult for the Biden administration. This action may impact union support for the President who has consistently called for “new, high-paying union jobs” as part of his economic stimulus packages.

The administration hopes to repair somewhat strained relations with Japan- a key trading partner. This deal is similar to last year’s agreement with the European Union; it will allow duty-free steel imports of up to 1.25 million metric tons into the U.S. Imports above that level will be subject to a 25 percent tariff.

Politico reported on response from the steel industry, providing quotes from the Steel Manufacturers Association (SMA) and the American Iron and Steel Institute (AISI):

“This is a strong deal for American steelmakers and it shows that we should not take a one-size-fits-all approach when it comes to our jobs, environment and economic growth,” said Philip Bell, SMA president and CEO.

Kevin Dempsey, AISI president, added that “proper implementation and enforcement” of the new tariff arrangement will be key to preventing a surge of imports.

Ambassador Katharine Tai released the following statement:

“Since Day One, the Biden Administration has been committed to working with our allies and partners to address shared challenges. In reaching this agreement with Japan, one of our most important trading partners, we are taking another step forward in our mission to rebuild and revitalize these important relationships.

“This agreement, combined with last year’s resolution with the European Union, will help us work together with Japan to combat China’s anti-competitive, non-market trade actions in the steel sector, while helping us reach President Biden’s ambitious global climate agenda.

“Importantly, this agreement represents an important example of our worker-centered trade policy in action. It will defend opportunities for a vital American industry, our workers, and their families as we work to deliver trade policies that can unlock broad-based economic prosperity and growth.”

Commerce Secretary Gina M. Raimondo said:

“As part of our work to reinvigorate America’s manufacturing economy and bring down costs for consumers and businesses, President Biden directed us to renegotiate the 232 steel measures with Japan to allow duty-free imports into the United States. I’m pleased to announce the deal we reached will strengthen America’s steel industry and ensure its workforce stays competitive, while also providing more access to cheaper steel and addressing a major irritant between the United States and Japan, one of our most important allies.

“Today’s announcement builds on the deal we struck with the EU and will further help us rebuild relationships with our allies around the world as we work to fight against China’s unfair trade practices and create a more competitive global economy for America’s families, businesses and workers.

“I’d like to sincerely thank our counterpart at Japan’s Minister of Economy, Trade and Industry Hagiuda Koichi, for his determination and resolve, as well as Ambassador Rahm Emanuel for his partnership in this effort.”

For more info visit:

https://ustr.gov/about-us/policy-offices/press-office/press-releases/2022/february/tai-raimondo-statements-232-tariff-agreement-japan

https://www.reuters.com/world/asia-pacific/japan-us-announce-deal-restrict-trump-era-steel-tariffs-bloomberg-2022-02-07/

New Residential Construction Shows Strength in December:

From NAHB:

Driven by strong buyer demand and the expectation of higher mortgage rates, new home sales ended the year on a strong note, reaching their highest level since March 2021.

Sales of newly built, single-family homes in December increased 11.9% to an 811,000 seasonally adjusted annual rate from a downwardly revised reading in November, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. New home sales were down 7.3% in 2021 compared to the previous year.

“Though builders continue to grapple with higher construction costs, the December data reveal ongoing demand for new construction, given lean inventories of resale homes,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla.

“The double-digit sales gain in December was likely due to motivated buyers who were seeking to sign sales contracts before interest rates move higher at the start of 2022,” said NAHB Chief Economist Robert Dietz. “Higher interest rates this year will price out some buyers from the market, but the existing home inventory shortfall remains.”

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the December reading of 811,000 units is the number of homes that would sell if this pace continued for the next 12 months.

Inventory remained steady at a 6-months’ supply, with 403,000 new single-family homes for sale, up 34.8% from December 2020.

The median sales price fell to $377,700 from $416,100 in November, however it was up from the $365,300 median price posted a year ago, due primarily to higher development costs, including materials.

Regionally, on a year-to-date basis, new home sales fell in all four regions, down 5.8% in the Northeast, 7.6% in the Midwest, 5.9% in the South and 10.5% in the West.

For more info see:

https://www.nahb.org/news-and-economics/industry-news/press-releases/2022/01/new-home-sales-post-solid-gain-in-december

Good News and Bad News For Existing Home Sales

Existing home sales ended 2021 at 6.12 million- up 8.5% from 2020 and at the highest annual level since 2006. December 2021 existing-home sales slowed to an annualized rate of 6.18 million, down 4.6% decrease from November.

Looking ahead to 2022, the inventory of unsold existing homes fell to an all-time low of 910,000 in December, which is equivalent to 1.8 months of monthly sales. This inventory level is also the lowest since January 1999.

The lower inventory- coupled with the December decline- should keep home resales lower for the upcoming months. This decline could negatively impact remodeling related to home ownership changes, but as supply chains continue to ease for new construction, could continue to drive new home construction demand even amid higher home prices.

”December saw sales retreat, but the pull-back was more a sign of supply constraints than an indication of a weakened demand for housing,” said Lawrence Yun, NAR’s chief economist. “Sales for the entire year finished strong, reaching the highest annual level since 2006.”

For more info, see:

https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

Fire Safety: Tragedies Highlight the Importance of Code Compliance

Two recent tragic fires in multi-family buildings in Philadelphia and New York City resulted in the deaths of 29 people, including 17 children, and left scores injured. IDA is concerned with the circumstances that led to these tragedies and wants to express our heartfelt sympathies to those affected.

These horrific events highlight the need for increased attention to the fire safety in existing buildings. Overcrowding, use of space heaters, lack of smoke alarms, building code violations, and lack of maintenance have been cited as contributing factors to the injuries and fatalities.

IDA is concerned about fire safety in our buildings and has been a staunch advocate for enforcement of fire code provisions mandating annual inspections of fire doors, including rolling steel as well as side-hinged entry doors. The use of fire doors in fire-rated walls as part of a balanced approach to building fire safety is an important part of safety strategy by design. IDA will continue to promote compliance to the annual inspection and testing requirements of our products.

For additional information see:

https://www.nfpa.org/News-and-Research/Publications-and-media/Blogs-Landing-Page/NFPA-Today/Blog-Posts/2022/01/05/Tragic-Philly-home-fire-kills-13-underscoring-the-importance-of-working-smoke-alarms

https://www.nbcnewyork.com/news/local/deadly-nyc-apartment-fire-spread-due-to-open-door-a-common-tragedy-in-the-city/3487124/

https://www.dailymail.co.uk/news/article-10384341/People-seen-jumping-windows-Bronx-apartment-building-fire.html

https://www.cnn.com/2022/01/10/us/new-york-philadelphia-fires/index.html

Residential Construction: Good News Again as Housing Gains Continue

The already-strong demand for new housing accelerated in November, as new housing starts rose 11.8% to a seasonally adjusted annual rate of 1.68 million units According to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, single-family starts rose 11.3% while the multifamily sector, which includes apartment buildings and condos, increased by 12.9%.

The NAHB reported that low inventory of existing homes for resale is responsible for the demand surge but noted that the market is being restrained by supply issues. Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. Said “policymakers need to help alleviate ongoing building material supply chain bottlenecks that are preventing builders from keeping up with buyer demand.”

Another trend noted by NAHB is the shift away from multi-family housing to single family homes.

“Breaking an eight-year trend, in recent months there have been more single-family homes under construction than multifamily units,” said NAHB Chief Economist Robert Dietz. “Moreover, despite some cooling earlier this year, the continued strength of single-family construction in 2021 means there are now 28% more single-family homes under construction than a year ago. These gains mean single-family completions will increase in 2022, bringing more inventory to market despite a 19% year-over-year rise in construction material costs and longer construction times.”

For more info see: https://www.nahb.org/news-and-economics/industry-news/press-releases/2021/12/double-digit-gains-for-single-family-and-multifamily-production-in-november

Existing Home Sales: Market Conditions Hold Steady as Resales Continue to Rise

The home resale market showed another gain for the 3rd straight month as November sales of existing homes increased 1.9% in November from October. Prices also continued the upward trend, as the median existing-home sales price rose 13.9% year-over-year to $353,900. The inventory of unsold homes in the market decreased 13.3% to 1.1 million – equivalent to just over 2 months-worth of home sales.

Continued low mortgage rates have been cited as fueling resale demand. Lawrence Yun, chief economist for the National Association of Realtors (NAR) said he forecasts the 30-year fixed mortgage rate to increase to an average at 3.7% by the end of 2022.

“Determined buyers were able to land housing before mortgage rates rise further in the coming months,” Yun said. “Locking in a constant and firm mortgage payment motivated many consumers who grew weary of escalating rents over the last year.”

For more info, see: https://www.nar.realtor/newsroom/existing-home-sales-continue-upward-increasing-1-9-in-november

Residential Construction

Single-family residential construction dropped by 0.7% to a seasonally adjusted annual rate of 1.52 million units, according to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The October projection of 1.52 million starts is represents the number of housing units that would be constructed if development continued at this pace for the next 12 months. The details in the agencies’ report show that single-family starts decreased 3.9% to a 1.04 million seasonally adjusted annual rate but are still up 16.7% year-to-date. Multifamily construction, including apartments and condos, increased 7.1% to an annualized 481,000 rate.

The NAHB blames the stalling construction numbers on continued issues within the supply chain, and particularly lumber.

“The rising count of homes permitted but not yet started construction is a stark reminder to policymakers to fix the supply chain so that builders can access a steady source of lumber and other building materials to keep projects moving forward,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla.

The NAHB is also gearing up opposition to a potential doubling of tariffs on lumber shipments from Canada- from 9% to 17.9%.

“With the nation in the midst of a housing affordability crisis, the Biden administration has moved to slap a huge, unwanted tax hike on American home buyers and renters by doubling the tariffs on Canadian lumber shipments into the U.S. This is the worst time to add needless housing costs onto the backs of hardworking American families. Home builders are grappling with lumber and other building material supply chain bottlenecks that are raising construction costs. And consumers are dealing with rising inflation that is pushing mortgage interest rates higher,” said Fowke.

For more info see: https://www.nahb.org/news-and-economics/industry-news/press-releases/2021/11/supply-side-disruptions-push-single-Family-production-down-in-october

Existing Home Sales

The home resale market showed a slight increase in October, as sales increased 0.8% in October to a seasonally adjusted annual rate of 6.34 million. At the same time, pricing continued to increase with a median price increase of 13.1% year-over-year to $353,900. Meanwhile, the unsold homes inventory fell 12% to 1.25 million, which equates to about 2-1/2 months-worth of sales at the current pace.

The National Association of Realtors remains guardedly optimistic. “Home sales remain resilient, despite low inventory and increasing affordability challenges,” said Lawrence Yun, NAR’s chief economist. “Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

For more info, see: https://www.nar.realtor/newsroom/existing-home-sales-inch-up-0-8-in-october

Mixed Messages: Data Devil is in the Details

New Housing Economy

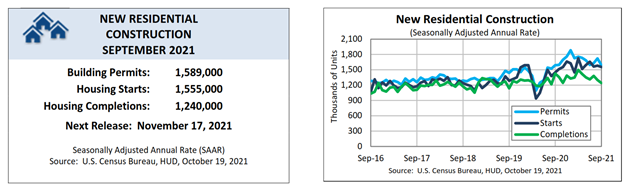

Single-family housing starts held steady in September while multi-family production dropped, resulting in an overall drop in housing unit starts of 1.6%. The Department of Housing and Urban Development, and the U.S. Census Bureau reported an annualized rate of 1.56 million units; that figure represents an annual rate should that level continue. Even with the flat production level in September, single-family starts in 2021 are 20.5% higher year-to-date.

Building material pricing and other supply chain issues are cited as key factors in maintaining the construction economy.

“Single-family construction continued along recent, more sustainable trends in September,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. “Lumber prices have moved off recent lows, but the cost and availability of many building materials continues to be a challenge for a market that still lacks inventory. Policymakers should continue to work to improve supply-chains.”

“Builder confidence increased in October, which confirms stabilization of home construction at current levels,” said NAHB Chief Economist Robert Dietz. “The number of single-family units in the construction pipeline is 712,000, almost 31% higher than a year ago as more inventory is headed to market. Multifamily construction has expanded as well, with almost a 6% year-over-year gain for apartments currently under construction.”

A recent NAHB blog post illustrates the impact. “Despite the increase, builders are getting increasingly concerned about affordability hurdles ahead for most buyers,” the NAHB wrote on its blog. “Building material price increases and bottlenecks persist and interest rates are expected to rise in coming months as the Fed begins to taper its purchase of U.S. Treasuries and mortgage-backed debt.”

A note of caution: permit activity fell in September, possibly signaling a declining market ahead; multi-family permits dropped 18.3% in September while single-family fell 0.9%.

Labor availability also affects the construction sector. According to the U.S. Department of Labor Statistics, construction employment increased by 22,000 jobs in September but has shown little net change thus far this year. Employment in construction is still 201,000 below its February 2020 level.

For more info, visit: https://www.nahb.org/news-and-economics/industry-news/press-releases/2021/10/single-family-starts-flat-in-september

Residential Remodeling Market

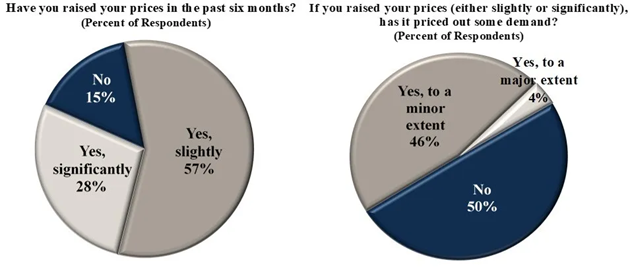

The NAHB reported that the NAHB/Royal Building Products Remodeling Market Index (RMI) for the third quarter of 2021 was up five points from the third quarter of 2020, with an index of 87. The reading indicates positive residential remodeler sentiment, across all project sizes.

The RMI is based on a comprehensive survey of remodeling contractors. The third quarter survey returned some interesting takeaways concerning labor availability and material costs, and the impact on the remodeling market.

“There is strong demand and continued optimism in the residential remodeling market, despite the fact that supply constraints are severe and widespread. For example, well over 90% of remodelers in the third quarter RMI survey reported a shortage of carpenters. And 57% of remodelers reported having slightly raised prices for projects over the last six months, with another 28% indicating a significant increase in price, due in part to higher material costs and ongoing strong demand. Half of these remodelers reported some pricing out of demand due to higher prices for remodeling projects.”

Source: eyeonhousing.org

For more info visit: https://eyeonhousing.org/2021/10/remodeling-industry-confidence-improves-year-over-year-2/

Existing Home Market

The National Association of Realtors reported that September showed increased home resale values across all U.S. regions. The highlights from September include:

- Existing-home sales in the U.S. increased 7% in September from August, on a seasonally adjusted annual rate, with all regions showing an increase.

- The inventory of unsold homes decreased 13% to 1.27 million compared to 2020, and inventory dipped 0.8% compared to August.

- Median existing-home sales prices rose 13.3% above 2020 levels to $352,800.

According to NAR, the mortgage market is directly impacting existing home sales. “Some improvement in supply during prior months helped nudge up sales in September,” said Lawrence Yun, NAR’s chief economist. “Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year.”

For more info visit: https://www.nar.realtor/newsroom/existing-home-sales-ascend-7-0-in-september

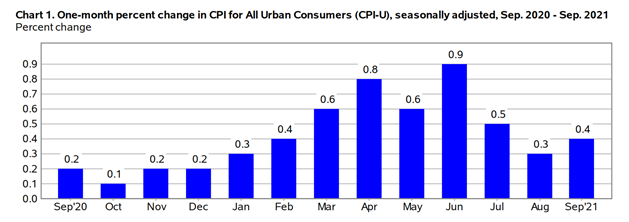

Consumer Price Index Increases

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in September. Over the last 12 months, the “all items” index increased 5.4 percent before seasonal adjustment.

For more info visit: https://www.bls.gov/news.release/pdf/cpi.pdf

IDA Industry Affairs September 2021:

Recovery Continues….

Multi-Family Starts Strong; Offsetting Single Family Housing Starts Decline

Multi-family housing starts dropped 2.8% in August while multi-family starts (including apartments and condos) increased by a whopping 20%. Even with the drop, single family starts are ahead of 2020 YTD by 23.8%.

“Single-family construction is normalizing at more sustainable levels after an increase in building material pricing,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. “Demand remains strong, but the market is facing increasing housing affordability issues after a run-up in new and existing home prices. Multifamily construction increased in August, with NAHB expecting a solid gain for apartment construction in 2021 after a slight decline last year.”

According to NAHB, material prices, supply-chain delays and skilled labor shortages continue to hold the market back. With building permit activity holding steady, the market looks to stabilize in the months to come.

For more info, visit: https://www.nahb.org/news-and-economics/industry-news/press-releases/2021/09/august-housing-starts-lifted-by-multifamily-development

Existing Home Sales Down 2% in August

The National Association of Realtors released August data; here are the highlights:

- The median existing-home sales price rose 14.9% over 2020.

- Existing-home unit sales dropped 2% from July to August.

- The inventory of unsold homes decreased 1.5% to 1.29 million from July to August – equivalent to 2.6 months of the monthly sales pace.

From the NAR:

“Sales slipped a bit in August as prices rose nationwide,” said Lawrence Yun, NAR’s chief economist. “Although there was a decline in home purchases, potential buyers are out and about searching, but much more measured about their financial limits, and simply waiting for more inventory.”

For more info visit: https://www.nar.realtor/newsroom/existing-home-sales-recede-2-0-in-august

Consumer Price Index Increase Slows

The Consumer Price Index for All Urban Consumers rose 5.3 percent for the 12 months ending August 2021, compared to the 5.4-percent rise for the year ending July. Prices for all items less food and energy rose 4.0 percent over the last 12 months, also a smaller increase than the year ending July. The increase was led by energy prices with a 25.0 percent increase over the last 12 months.

For more info visit: https://www.bls.gov/opub/ted/2021/consumer-price-index-rose-5-3-percent-over-the-year-ending-august-2021.htm

IDA Industry Affairs August 2021: Recovery Slows As Market Constraints and Supply Chain Disruptions Continue

Housing Starts Dropped in July: Supply Chain, Supply Chain, Supply Chain

The U.S. housing economy reversed the recent uptick trend with lower starts in July, but that slowdown may be short-term based on an increase in building permit activity. New permits precede starts and are a good indicator of short-term construction activity. Cost increases for building materials, components, and products, combined with shortages and delays (as well as labor shortages) are impacting the construction time.

NAHB reports that supply chain issues are the chief reason for the drop in new home starts, citing the high cost of building materials and prices, production bottlenecks and labor shortages. For builders, time is money. Recent lumber price decreases may be a sign of relaxed supply issues but there is no immediate expectation that the cost of construction- including labor- will return to pre-COVID levels.

From NAHB.org:

Supply chain and labor challenges helped to push overall housing starts down 7.0 percent to a seasonally adjusted annual rate of 1.53 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The July reading of 1.53 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 4.5 percent to a 1.11 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, decreased 13.1 percent to a 423,000 pace.

“The latest starts numbers reflect declining builder sentiment as they continue to grapple with high building material prices, production bottlenecks and labor shortages,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. “Policymakers need to prioritize the U.S. supply chain for items like building materials to ensure builders can add additional inventory the housing market desperately needs.”

“The decline in single-family permits indicates that builders are slowing construction activity as costs rise,” said NAHB Assistant VP of Forecasting & Analysis Danushka Nanayakkara-Skillington. “Starts began the year on a strong footing but in recent months some projects have been forced to pause due to both the availability and costs of materials.”

On a regional and year-to-date basis (January through July of 2021 compared to that same time frame a year ago), combined single-family and multifamily starts are 27.7 percent higher in the Northeast, 20.8 percent higher in the Midwest, 18.5 percent higher in the South and 27.7 percent higher in the West.

Overall permits increased 2.6 percent to a 1.64 million unit annualized rate in July. Single-family permits decreased 1.7 percent to a 1.05 million unit rate. Multifamily permits increased 11.2 percent to a 587,000 pace.

Looking at regional permit data on a year-to-date basis, permits are 24.9 percent higher in the Northeast, 23.0 percent higher in the Midwest, 25.9 percent higher in the South and 28.2 percent higher in the West.

For more info, visit: https://www.nahb.org/news-and-economics/industry-news/press-releases/2021/08/housing-starts-down-in-july-on-supply-chain-challenges

Existing Home Sales

Existing home sales may have peaked, but the seller’s market continues albeit softened somewhat. With two consecutive months of unit sales increases combined with inventory increases, the surge in median selling price is expected to slow. Increased home resales activity tends to trigger an increase in garage door and opener replacement, as sellers look to upgrade their curb appeal, or as buyers take on new remodeling projects. Mortgage rates- which impact new home sales as well as resales- decreased slightly in July, helping to maintain the strong market.

From the NAR:

WASHINGTON (August 23, 2021) – Existing-home sales rose in July, marking two consecutive months of increases, according to the National Association of Realtors®. Three of the four major U.S. regions recorded modest month-over-month gains, and the fourth remained level. Figures varied from a year-over-year perspective as two regions saw gains, one witnessed a decline and one was unchanged.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.0% from June to a seasonally adjusted annual rate of 5.99 million in July. Sales inched up year-over-year, increasing 1.5% from a year ago (5.90 million in July 2020).

“We see inventory beginning to tick up, which will lessen the intensity of multiple offers,” said Lawrence Yun, NAR’s chief economist. “Much of the home sales growth is still occurring in the upper-end markets, while the mid- to lower-tier areas aren’t seeing as much growth because there are still too few starter homes available.”

Total housing inventory at the end of July totaled 1.32 million units, up 7.3% from June’s supply and down 12.0% from one year ago (1.50 million). Unsold inventory sits at a 2.6-month supply at the present sales pace, up slightly from the 2.5-month figure recorded in June but down from 3.1 months in July 2020.

The median existing-home price for all housing types in July was $359,900, up 17.8% from July 2020 ($305,600), as each region saw prices climb. This marks 113 straight months of year-over-year gains.

“Although we shouldn’t expect to see home prices drop in the coming months, there is a chance that they will level off as inventory continues to gradually improve,” said Yun.

“In the meantime, some prospective buyers who are priced out are raising the demand for rental homes and thereby pushing up the rental rates,” he added.

For more info visit: https://www.nar.realtor/newsroom/existing-home-sales-climb-2-0-in-july

Non-residential Spending

Construction activity through June 2021 for non-residential projects in the U.S. was stagnant in June (based on revised data from May as reported by the US Census Bureau) with an increase of 0.4% in private construction- led by strong residential construction spending- offset by a 1.2% drop in public spending.

From the US Census Bureau:

Total Construction

Construction spending during June 2021 was estimated at a seasonally adjusted annual rate of $1,552.2 billion, 0.1 percent (±1.2 percent) above the revised May estimate of $1,551.2 billion. The June figure is 8.2 percent (±1.3 percent) above the June 2020 estimate of $1,435.0 billion. During the first six months of this year, construction spending amounted to $736.5 billion, 5.4 percent (±1.0 percent) above the $698.8 billion for the same period in 2020.

Private Construction

Spending on private construction was at a seasonally adjusted annual rate of $1,215.2 billion, 0.4 percent (±0.7 percent) above the revised May estimate of $1,210.3 billion. Residential construction was at a seasonally adjusted annual rate of $763.4 billion in June, 1.1 percent (±1.3 percent) above the revised May estimate of $755.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $451.8 billion in June, 0.7 percent (±0.7 percent) below the revised May estimate of $454.9 billion.

Public Construction

In June, the estimated seasonally adjusted annual rate of public construction spending was $337.0 billion, 1.2 percent (±2.0 percent) below the revised May estimate of $340.9 billion. Educational construction was at a seasonally adjusted annual rate of $81.3 billion, 0.8 percent (±4.4 percent) below the revised May estimate of $82.0 billion. Highway construction was at a seasonally adjusted annual rate of $92.4 billion, 5.3 percent (±4.6 percent) below the revised May estimate of $97.5 billion.

For more info, see: https://www.census.gov/construction/c30/pdf/release.pdf

IDA Industry Affairs July 2021

Midway Through 2021: Building and Construction Economy Remains Strong, But…

Supply Chain Issues Continue to Restrain Further Growth

First Half Review

The first six months of 2021 U.S. construction activity are in the books, and the news is mostly good. According to Dodge Data and Analytics, commercial and multifamily starts in the top 20 metropolitan areas of the U.S. gained 12% in value during the first six months of 2021, compared to the first half of 2020. Commercial and multifamily construction starts in the U.S. were up 10% year-to-date through six months. In the top 10 metro areas within the U.S. through June, commercial and multifamily construction starts were up 12% with only three metro areas (Washington, DC; Los Angeles, CA; and Austin, TX) showing declines.

Construction moratoriums and project delays hit many of the country’s largest cities during the beginning stages of the pandemic, resulting in very low construction activity in April and May 2020. While that 2020 drop makes the 2021 data look more favorable, the overall trend is positive.

For more info see: Construction.com

Residential Construction

New residential construction increased in June with housing starts up 6.3%. The catch? Building permits dropped in June, a sign that we will likely see a decline in housing starts in months to come. The NAHB blames supply chain issues for the weakened permit activity.

“While lumber prices have just recently begun to trend downward, builders continue to deal with rising prices of other building materials, such as oriented strand board, and major delays in the delivery of these goods,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, FL, “We are thankful that the White House recently held a meeting to seek solutions to these supply chain issues that are harming housing affordability.”

“The recent weakening of single-family and multifamily permits is due to higher material costs, which have pushed new home prices higher since the end of last year,” said NAHB Chief Economist Robert Dietz. “This is a challenge for a housing market that needs additional inventory.”

Non-residential Spending

Construction activity through June 2021 for non-residential projects in the U.S. shows signs of recovery. While still down 11% on a year to date basis, the volume of spending in June 2021 was up more then 14% from May.

For more info, see: Construct Connect

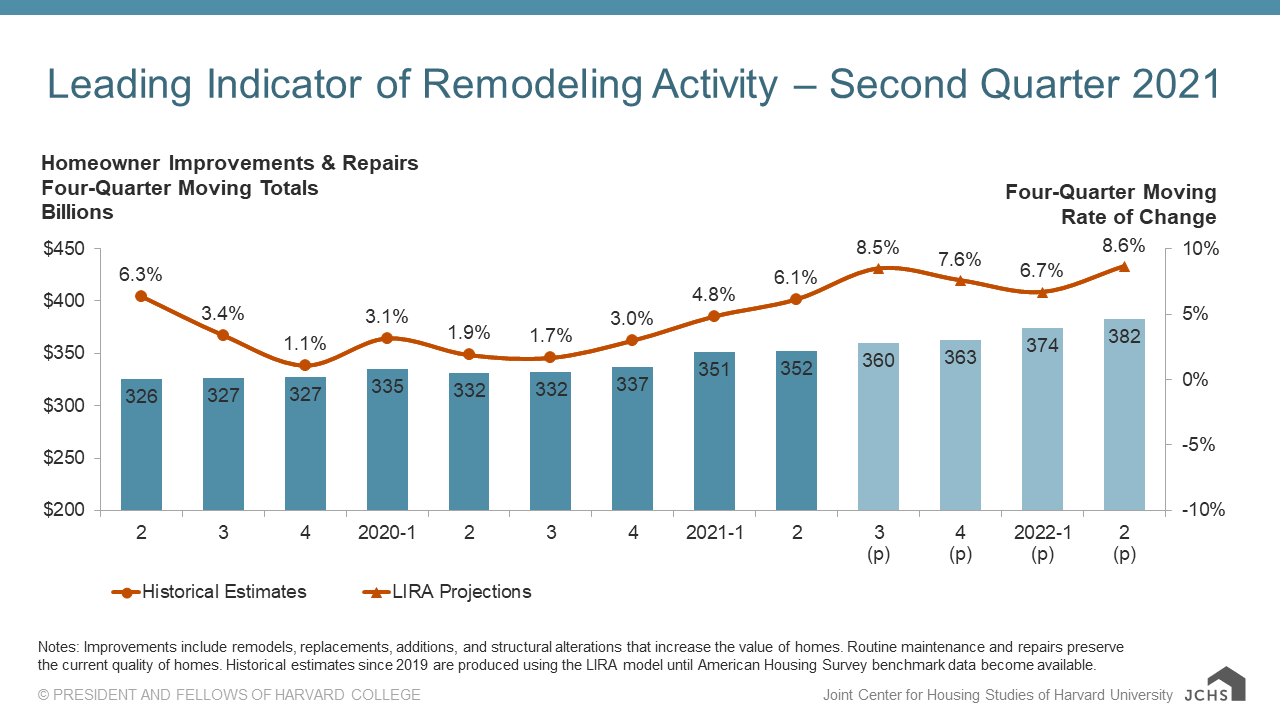

Residential Remodeling

Spending for homeowner improvement and maintenance are likely to increase through 2021 and remain strong through mid-year 2022, according to the Leading Indicator of Remodeling Activity (LIRA) from the Joint Center for Housing Studies of Harvard University. LIRA projects an 8.6% annual growth in home renovation and repair expenditures over the next year.

“Home remodeling will likely grow at a faster pace given the ongoing strength of home sales, house price appreciation, and new residential construction activity,” says Chris Herbert, Managing Director of the Joint Center for Housing Studies in a recent media release. “A significant rise in permits for home improvements also indicates that owners are continuing to invest in bigger discretionary and replacement projects.”

It’s not just about contractor remodeling, however. “Larger gains in retail sales of building materials suggest the remodeling market continues to be lifted by DIY activity as well,” says Abbe Will, Associate Project Director in the Remodeling Futures Program at the Center.

For more info see: National Association of Home Builders (NAHB), and the Joint Center for Housing Studies of Harvard University (JCHS) of Harvard University

Workforce Issues

Construction unemployment and employment in the U.S. are showing marked improvements over last year. While not back to the pre-pandemic level, it does seem to show that at least part of the two-pronged supply chain factors- materials and labor shortages- are on the way to recovery, according to the Associated Builders and Contractors (ABC).

“The widespread availability of COVID-19 vaccines and the economy’s bounce back are boosting the construction industry,” said Bernard M. Markstein, Ph.D., president, and chief economist of Markstein Advisors, who conducted the analysis for ABC. “The strength of the economic recovery will be tested in coming months by the delta variant and as the outflow of funds from the American Rescue Plan Act starts to dry up. Congress is working to address the nation’s long-standing need to repair and upgrade its infrastructure, and a qualified workforce will be necessary to get the infrastructure built. Yet a skilled workforce shortage persists. If a commonsense, bipartisan infrastructure bill is enacted into law, the economy, the construction industry and the construction workforce will benefit.”

For more info see: Contractor Magazine

https://www.contractormag.com/construction-data/article/21170860/abc-construction-unemployment-rates-down-in-45-states

The U.S. Department of Labor announced a rule rescission of Joint Employer Status rule. Here is the press release:

The U.S. Department of Labor today announced a final rule to rescind an earlier rule, “Joint Employer Status under the Fair Labor Standards Act” that took effect in March 2020. By rescinding that rule, the Department will ensure more workers receive minimum wage and overtime protections of the Fair Labor Standards Act.

The rescinded rule included a description of joint employment contrary to statutory language and Congressional intent. The rule also failed to take into account the department’s prior joint employment guidance. The U.S. District Court for the Southern District of New York vacated most of the rule in 2020.

Under the FLSA, an employee can have more than one employer for the work they perform. Joint employment applies when – for the purposes of minimum wage and overtime requirements – the department considers two separate companies to be a worker’s employer for the same work. For example, a joint employer relationship could occur where a hotel contracts with a staffing agency to provide cleaning staff, which the hotel directly controls. If the agency and the hotel are joint employers, they are both responsible for worker protections.

A strong joint employer standard is critical because FLSA responsibilities and liability for worker protections do not apply to a business that does not meet the definition of employer.

The final rule becomes effective September 28, 2021.

For more information about the FLSA or other laws it enforces, visit the Wage and Hour Division, or call toll-free 1-866-4US-WAGE.

The National Association of Manufacturers filed comments in opposition to the rule rescission. While the change will impact manufacturing, the effects will likely be felt across most industries, including construction, retail, hospitality, and service economies.

For more information visit: U.S. Department of Labor

“IDA has heard from many of our members about difficulties they are experiencing with delays, back orders, and unstable pricing. We hope this edition of the IDA Industry Affairs will provide our members with a better understanding of what is happening and offer some suggestions to help them deal with the disruptions they face.” – Brenton Cheney, IDA President |

The Rules are Different: How Door Dealers Can Navigate Supply Chain Disruptions and Market Volatility What is going on? The perfect storm of COVID-19 disruptions in manufacturing, increased import tariffs, last year’s hurricane season, oil refinery shutdowns due to this past winter’s Texas snowstorm, and labor shortages, have collided to create chaos in the US supply chain. The construction industry is not alone in facing this reality. U.S. automakers are dealing with shortages of computer chips, the energy industry has experienced slowdowns due to unavailability of simple parts like pipe couplings, and let’s not forget the grocery store shelves devoid of toilet paper, disinfectant, and other household supplies. That these disruptions are happening during a booming new construction and remodeling economy completes the good news-bad news scenario. The construction materials industry has been impacted with shortages and price volatility in lumber and other wood products, plastics used in building products like insulation, siding and composite products, and metals including copper, steel, and aluminum. Lumber pricing in particular has been on a roller-coaster ride. For the door industry, the pipeline is reliant on a steady flow of doors and openers into a supply chain operating on a normally efficient and economic “just-in-time” inventory world. In this relay-race economy, when one runner drops the baton the race comes to a screeching halt. Manufacturing of doors and openers relies on the availability of steel and plastic raw materials, processing of those materials into components, and the fabrication and assembly processes that complete the products. Every step in the process depends on the availability of labor. Unfilled job openings coupled with COVID protocols that impact productivity throughout the economy further hamper factory output and field installation. Steel for doors, openers, track and hardware… foam plastic insulation… motors and other electronic components… none of the ingredients have been left out of the disruption. It’s not only about costs. Availability, delays, and back orders are now an everyday occurrence. |

What are others saying about the chaos?

|

|

What can door dealers do to minimize the adverse impacts? Triage The first step to understanding what can be done is to make sure to complete a full risk assessment of your own supply chain. This form of triage means reviewing all sales orders, contracts, and proposals to determine what exposure lies ahead. It also means ensuring that purchasing agreements are locked in- in writing- to avoid cancellations or changes in lead times and pricing. Include suppliers in this audit to help them better understand your needs; if they aren’t completely in the loop on your expectations they won’t be in a position to help. Workforce Assessment Another factor to consider is labor availability; with the availability of additional installation and service labor in question, the scheduling process has become even more challenging. Implement a scheduling tool that can consider project timelines, ordering, manufacturing and logistics so that as the inevitable disruptions occur your organization will be nimble and responsive. Communicate Once you have a full assessment of your own supply chain issues, the most important step is to maintain open lines of communications with customers, suppliers, and employees. It is more important than ever to be proactive in reaching out to share project or order updates; even if the news is no news, your customers will feel more valued. The same principles apply to everyone involved, including suppliers and employees. Thinking of all affected parties as partners will go a long way towards maintaining trust and building teamwork. In this economy, good relationships are paramount. Don’t be afraid of the hard conversations. Your customers understand what’s happening in this economy, and will likely be much more forgiving of delays or price increases if they are informed promptly. If that call means a customer may go elsewhere, they will remember that you were forthcoming. It is better to lose an order than a customer- especially in an industry that depends on word of mouth and repeat business. Look ahead We have grown weary of hearing the word “unprecedented” but it’s safe to say that most companies in business today have not faced this kind of disruption. Not since World War II has the U.S. been forced to address a complete reinvention of the economy, from imports, mining, manufacturing, rationing, recycling, repurposing and rethinking labor. The next time something similar happens, we should be prepared. Reassess your company strategies on inventory to prepare for future shortages. Revisit your sales approach and contracts and supplier terms to avoid being trapped by unfavorable deals. Rethink your workforce to make the most of what you have by cross-training technicians to increase their capabilities and value. In short, take the opportunity to reinvent and reimagine how you do business. |

What are some other perspectives? Remember that the door industry is not alone in this new abnormal; the entire construction industry is facing the same chaos. Here is some advice from others:

|

What other information may be helpful to understand the issues and how to respond? Here are some links that may be of interest: From the Associated General Contractors (AGC):

|

How can I learn more? For more information, to comment or ask a question about the state of the door industry supply chain, please reach out to IDA at info@doors.org or add a comment to the IDA Community Facebook Group. |

Construction EconomyHousing Starts Dropped in April; Ahead of 2020 After months of increased activity, U.S. single-family housing starts declined in April but remain well ahead of 2020 levels. The drop is attributed to increased costs of building materials, especially lumber. Production fell by 9.5% overall, with single-family numbers off by 13.4%. Multi-family units starts showed a slight increase of 0.8%, and permit activity for multi-family units increased by 8.9% in April; single-family dropped 3.8%. This split may mean that the trend will be short-lived as permit activity can help predict future starts. Total annualized starts are at 1.57 million; the number of homes permitted but not started is 47% above 2020 levels. “Housing starts and permits posted a monthly decline in April, as escalating prices for lumber and other building materials price out some home buyers from an otherwise hot housing market,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. “Policymakers need to prioritize the U.S. supply chain for items like building materials to ensure builders can add the additional inventory the housing market desperately needs.” For more info: |

National Resales Dipped; Still Ahead of 2020 The National Association of Realtors (NAR) reported that existing homes sales dropped again in April, due mostly to the low inventory of homes on the market. Here are a few takeaways:

”Home sales were down again in April from the prior month, as housing supply continues to fall short of demand,” said Lawrence Yun, NAR’s chief economist. “We’ll see more inventory come to the market later this year as further COVID-19 vaccinations are administered and potential home sellers become more comfortable listing and showing their homes. The falling number of homeowners in mortgage forbearance will also bring about more inventory. ”Despite the decline, housing demand is still strong compared to one year ago, evidenced by home sales from this January to April, which are up 20% compared to 2020,” Yun continued. “The additional supply projected for the market should cool down the torrid pace of price appreciation later in the year.” For more info: |

Remodeling The remodeling industry is forecast to remain strong through 2021, but cool in 2022, according to Zonda. The impact of existing homes for sale inventory, slowing new housing starts due to material price increases, and COVID concerns have all worked to keep residential remodeling spending strong. How long that trend can be sustained is the question, especially if inflation impacts remodeling costs. For more info: |

Construction Economy |

Housing Bounces Back Big Time! After a slight decline in February, new housing starts surged during March as demand held firm, due in part to continued low mortgage rates. According to data released by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, housing starts jumped 19.4% to an annual rate of 1.74 million units. The increase in multifamily units topped 30.8%, while single family starts increased by 19.6%. “Builder confidence remains strong, pointing to gains for single-family construction in 2021,” said Chuck Fowke, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Tampa, Fla. “However, rising costs for most kinds of building materials continue to impede positive additional momentum in the market.” It should be noted that housing permits continue to outpace starts, meaning the current pace is likely to continue- at least for the short term. Material prices could affect how long the market bubble lasts, however. Construction materials costs remain a wild card as analysts look at recovery from the pandemic. For more information, visit NAHB or Construction Dive. |

Home Resales: Market Maintains Momentum…. Mostly: The National Association of Realtors (NAR) reported year over year gains in new home sales in March of 2021, with record-breaking sales price increase and inventory turnover. NAR reports these high-level points:

Existing homes sales often include home inspections as part of buyer’s due diligence. IDA recommends that door dealers reach out to professional home inspectors in their market and stress the importance of including a detailed review of the safety features and maintenance requirements of garage doors, operators and controls. Dealers can share the DASMA Home Inspector’s Checklist. For more information, visit the National Association of Realtors. |

Remodeling Remains Robust: The remodeling industry also continues to show signs of strength that should sustain well into 2022, according to updated data from the Leading Indicator of Remodeling Activity (LIRA), a quarterly outlook developed by the Joint Center for Housing Studies at Harvard University. “With a financial boost from recent federal stimulus payments and strong house price appreciation, homeowners are continuing to invest in the upkeep and improvement of their homes,” says Chris Herbert, Managing Director of the Joint Center for Housing Studies. “This lift in incomes and ongoing strength of the housing market are providing homeowners incentives to make even greater investments in their homes this year.” “Although the recent surge in DIY activity is slackening as the economy continues to open up, homeowners are undertaking larger discretionary renovations that had been deferred during the pandemic,” says Abbe Will, Associate Project Director in the Remodeling Futures Program at the Center. “A shift to more professional projects should boost annual homeowner remodeling expenditures to $370 billion by early next year.” The LIRA update for the first quarter of 2021 projects gains in home remodeling of 4.8% into 2022. Garage door replacements consistently rank as one of the best investments for property owners. For more information, visit the Joint Center for Housing Studies of Harvard University. |

Labor Shortage Restrains Recovery: While the leading economic indicators continue to show strength, other factors are holding back growth. Material prices and in some cases shortages and other supply chain issues are impacting manufacturing and materials availability. While those impacts are critical to recovery, it is the labor shortage that could be the next big bottleneck. According to the Homebuilders Institute (HBI), the availability of skilled tradespeople is a chief hindrance. ”The home building industry faces a major shortage of skilled workers,” says Ed Brady, HBI’s president and CEO. “This persistent challenge endangers the affordability and availability of housing and hinders a robust economic recovery. As a nation, we need to build the next generation of skilled tradespeople. That means recruiting more women. It means training and placing minority, lower income and at-risk youth for job opportunities as an important way to fight against social inequity. It means providing trade skills education to veterans and transitioning military. And it means reaching out to high school students, and those who influence their decisions, to change their perception of careers in the trades.” IDA will continue to advocate for jobs programs targeted at the construction and manufacturing trades; this issue will be an important and ongoing part of IDA’s advocacy efforts. For more information, visit CISION PR Newswire. |

Industry News to Note |

The Fenestration and Glazing Industry Alliance (FGIA) Releases Industry Report: Here are a few excerpts from the FGIA report and forecast: Schaumburg, Illinois – The Fenestration and Glazing Industry Alliance (FGIA) has released the FGIA 2020/2021 U.S. Industry Statistical Review and Forecast. This report delivers timely information on window, door and skylight market trends and product relationships. Historic data for 2012 through 2020 and forecast data for 2021 through 2023 are also included in the report. Forecasts are based on projections of construction activity as of March 2021. Residential Windows Residential prime window volumes grew by 1.5 percent in 2020 versus 2019. The increase was seen primarily in new construction with window demand increasing by 3.2 percent while remodeling and replacement demand was almost flat with a 0.2 percent increase. The outlook for residential window demand is a significant increase in 2021 due to the continued strength of the new housing market in particular, with expectations for a 6.8 percent increase in 2021, to be followed by a 1.8 percent increase in 2022. Residential Doors In the residential market, 2020 new construction demand for entry doors grew by 3.2 percent. Meanwhile, entry door remodeling and replacement demand, which continues to represent a significantly larger share of total demand, grew at 1.0 percent. The total market grew by 1.8 percent versus 2019 and is expected to grow significantly in 2021 due to strong single-family construction activity. 2022 and 2023 are expected to provide additional growth. Commercial Windows The non-residential glazing market decreased by 11 percent in 2020, with decreases across all applications. New construction shrank by 11 percent, while renovation demand decreased by 12 percent. A decline is forecast for 2021, with a rebound in 2022 and 2023. Commercial Doors In 2020, non-residential construction demand for entry doors shrank by 10.5 percent. Looking forward, a continued decline in 2021 is likely followed by a recovery in 2022 by 2.6 percent. After 2022, an additional slight recovery of 0.3 percent is expected. Residential Skylights Residential skylights closed the year at 1,120 thousand units, or just over 1.1 million, a growth rate of 4 percent over 2019 volume. New construction skylight activity was up 3 percent, while remodeling and replacement skylight activity was up 4 percent versus 2019. For the full report, visit FGIA. |

World Millwork Alliance (WMA) Scheduled for In-Person Conference in Fall 2021: After taking a 2-year hiatus, WMA is proceeding with plans for a fall event in Mobile, AL in October of 2021. For more information, visit World Millwork Alliance. |

Construction Economy |

Housing Starts Slow: According to data released by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, housing starts declined in February to an annual rate of 1.42 million units. The decline was steeper in multifamily units with a 15% drop, while single family showed a decline of 8.5% to an annual rate of 1.04 million units. Analysis by the National Association of Homebuilders (NAHB) indicated that a combination of factors triggered the decline, including higher mortgage rates, lumber and material cost increases, and winter storms. NAHB noted that 2021 is ahead of 2020, but the current pace will make it harder to match construction start gains that happened in the 3rd and 4th quarters of 2020. NAHB also cited shortages of some materials and products, including appliances, as reason for concern about the months ahead. NAHB Economist Robert Dietz stated that permit activity continues to outpace starts. “It is also worth noting that the number of single-family homes permitted but not started construction continued to increase in February, rising to 121,000 units. This is 36 percent higher than a year ago, as building material cost increases and delays slow some home building,” Dietz said. Despite the concerns about materials pricing, it appears that demand continues to outpace production. For more information, visit Eyes on Housing or the National Association of Home Builders. Click here for the full report from the U.S. Census Bureau. |

Existing Home Sales – Seller’s Market Continues: The housing demand factor continues to impact the existing homes sales data as well; the National Association of Realtors (NAR) reported that sales of existing homes dropped 6.6% in February to a seasonally-adjusted annual rate of 6.22 million, but note that sales are still outpacing 2020 by 9.1%. NAR also reports that existing-home sales prices in the U.S. are up, with all regions posting double-digit price gains. Housing inventory remained at a record-low of 1.03 million units, down 29.5% over 2020, with property sales averaging 20 days. Both the inventory and turnover are record lows. Learn more from the National Association of Realtors. |

Industry News to Note |

DASMA Executive Director Retires: John Addington, who served as Executive Director of DASMA for more than 30 years, is retiring and looks forward to more time with his family and turning his focus on supporting Cleveland’s sporting teams. During his tenure, John helped navigate the mergers of three distinct groups (NAGDM, DORCMA, and ARDI) into DASMA to provide a unified voice for the manufacturing sectors that serve the door industry. He built a team to support the technical and advocacy initiatives of the industry by creating the Technical Director position held by Joe Hetzel but now occupied by Gordon Thomas. IDA wishes John well and looks forward to continued collaboration with DASMA Executive Director Chris Johnson. Learn more from DASMA. |

Door Industry Lead Times: NAHB cited material and product shortages for the increased backlog and housing start decline, and it seems that the door industry is not immune. Door and Access Systems Newsmagazine surveyed manufacturers to try and identify what is contributing to the longer lead times reported by many IDA Dealer Members. The four most common factors are COVID impacts, unpredictable supply chains, material shortages, and increased demand. Increased demand for new construction is accompanied by increased activity in the replacement market; strong existing homes sales are linked to door replacement projects. Couple that with increased remodeling spending and the recipe for an increase in the retrofit market is complete. Visit DASMA for more info. |

Credit Card Merchant Fee Boosts Delayed: There is more than one way to impact consumer costs; but it seems that US Senator Dick Durbin, D-Ill, had his eye on the apparent efforts to sidestep rate caps with increased merchant fees. “They didn’t forget. They’re waiting for an opportunity to get even again. Where is the policing authority to stop this duopoly from doing this to every merchant and retailer in America?”, he asked. Durbin added that “adjustments” to interchange fees will add to the misery already felt by smaller merchants impacted by COVID restrictions. Durbin said fee increases could come “just in time for your little restaurant that somehow managed to survive and reopen in a pandemic to go into business and have your credit card company say now you’re going to pay us even more.” The “swipe fee” costs are “ultimately borne by consumers across America” because they will have to passed on to purchasers. The good news? Visa Inc. & MasterCard Inc. announced they will hold off on the planned increases in a statement earlier this month. “Visa is committed to maintaining stability in our payments system and will not make any future rate changes in the U.S. for another year while the economy recovers,” the company said. The bad news? The announcement means the issue isn’t going away, it’s just being shelved. For now. For more info, visit Digital Transactions or Bloomberg. |

2021: Moving Beyond COVID or Treading Water? |

The Rules Are Different: Navigating the construction economy and the small business landscape has never been trickier than it is today. Door dealers in particular face significant challenges on every front. From adopting new ways to engage with customers to enacting workplace rules to help prevent the spread of a highly contagious virus, the rules are indeed different. The best way to manage for today and tomorrow is to stay informed of all of the issues that will likely affect the door business and shape the successes or failures ahead. IDA will continue to provide high level information on the factors that will impact the construction economy and the regulatory landscape to help door dealers survive and thrive. It’s not just a new administration in the White House, or a global pandemic that can affect the door business. The February winter storm that froze Texas impacted refinery operations. While door dealers will see costs increase as a result of gasoline and diesel and fuel prices rising at the pump, the impact on refinery production may result in shortages and delays of plastics availability. Plastics are an important raw material for most insulated doors, so it is likely that product availability will be affected. |

What’s in the Policy Pipeline? |

PPP: The Bill is Coming Due, or The Taxman Cometh: The Paycheck Protection Program, or PPP, was a lifeline to many small businesses that were all but shutdown during the COVID Pandemic, and to the employees who would have likely faced layoffs. IDA helped lobby Congress to ensure the loan proceeds- which were forgiven provided the business met the criteria- would not be taxable income. Despite the success in overturning the IRS ruling, that result does not extend to state tax laws. While many states follow the IRS provisions through full adoption of the federal rules, many do not. In fact, some states will tax the PPP loan proceeds; in some cases, it will be through a state tax on income and in others a Gross Receipts Tax (GRT). IDA recommends that businesses that received PPP funding doublecheck with their state to determine what tax penalty may apply. For more information on this matter, and a state-by-state recap, visit the Tax Foundation website. |

Construction Stimulus Spending: Congress and the White House are finalizing another stimulus bill, that will include more direct benefits to taxpayers in the form of $1,400 checks for those who qualify. That is just one piece of the pie, however, as other components of the bill will draw attention during the negotiations. For now, it seems that an increase in the minimum wage will not make it into the bill, but an extension and expansion of unemployment benefits likely will survive. A significant part of the package will be aid to state and local governments; those provisions will likely include funding for construction spending on infrastructure and buildings. IDA will continue to track the bill and inform our members. |

Workforce Development and Career Expectations: President Biden signed an Executive Order that rescinded the Industry Recognized Apprenticeship Program (IRAP) that was enacted by former President Trump in 2017. The Trump administration launched IRAPs to establish a path for private apprenticeship programs by trade groups, educational institutions, and even labor unions. IRAPs removed much of the dependence on the US Department of Labor’s (DOL) Registered Apprenticeship Program (RAP) by allowing what in essence were competing programs. It takes time to develop these kinds of programs, so while many were in the development process, only one IRAP had been launched as of October 2020. The Biden Executive Order will remove that pathway and cut short private efforts. While the White House expressed concern over perceived shortcomings likely from industry programs, and a lack of quality control and DOL oversight, it should be noted that Democrats have expressed concerns about the potential for reduced funding for the DOL RAPs. Most labor unions opposed the Trump Administration initiative, and one group of unions mounted a successful fight to remove construction trades from the program, so while manufacturing groups could have implemented IRAPs the field trades would have been precluded. What can we learn? As we look ahead to predict how the Biden Administration will address workforce issues, this Executive Order shows the likely pro-union stance that will prevail under his office. Another glimpse into Biden’s plans can be found by looking at his stance on college education. Whether it is the debate on student loan forgiveness (which Biden has indicated he will oppose) or free tuition programs for qualified students attending community college, it must be noted there has been little about helping to grow the skilled labor work force that fuels the economy, especially in the building and construction sectors. Pushing more students through college will simply increase competition for the few well-paying jobs in sight. The blue-collar labor economy is ready and waiting to hire skilled and unskilled workers; diverting more workers into college programs and potentially into lower-paying jobs is a dead-end policy. |

For additional information on the workforce development, IRAPs, and Biden’s Executive Order, Visit:

|

Immigration Policy: Immigration, particularly issues arising from illegal entry of refugees from Mexico and Central American countries, gets most of the attention when we look at the policy question. Questions about preserving DACA, de-funding construction of the US/Mexico border fence, and increased illegal border crossings stay at the forefront of the discussion. The bigger issue for the construction industry is what role US immigration policy can play in helping fill the shortage of workers in construction and manufacturing sectors in the US. One of the easiest ways to address the issue is to find a solution to turn the illegal labor black market into a viable -and legal- work force. The solution will be complicated, and the negotiations will be difficult but finding a way to legalize those already here is the low-hanging fruit. |

For more on this topic visit: |

Vital Signs for the Door Industry: Construction Industry Metrics From 2021Here is an overview of relevant data shaping the US building and construction economy:

|

For more info, visit: |

For additional information on IDA’s Advocacy and Public Affairs activities, contact info@doors.org.